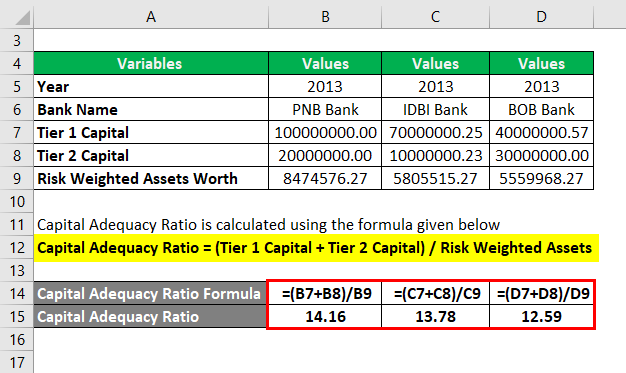

FDIC: FIL-86-2006: Proposed Rule on Risk-Based Capital Standards: Advanced Capital Adequacy Framework

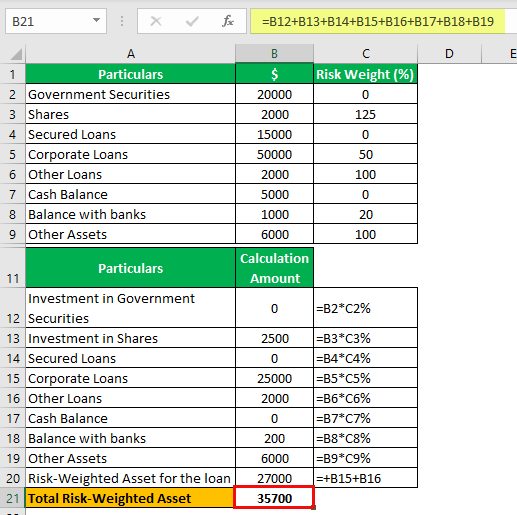

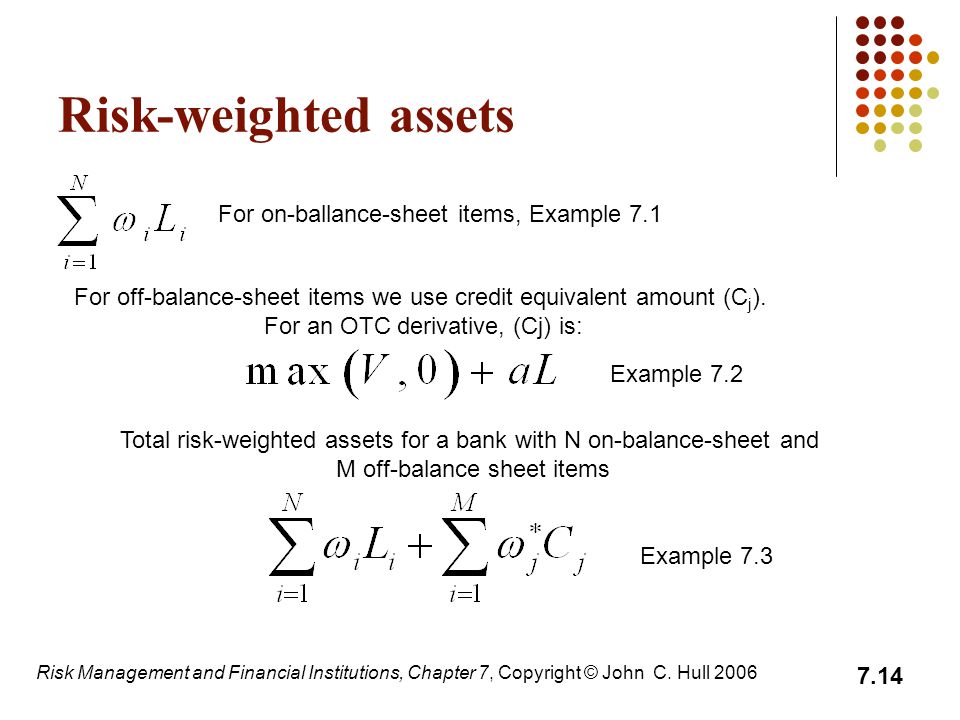

Risk Weighted Assets RWA under Basel 2: clear explanation with an Excel exercise and exemple - YouTube

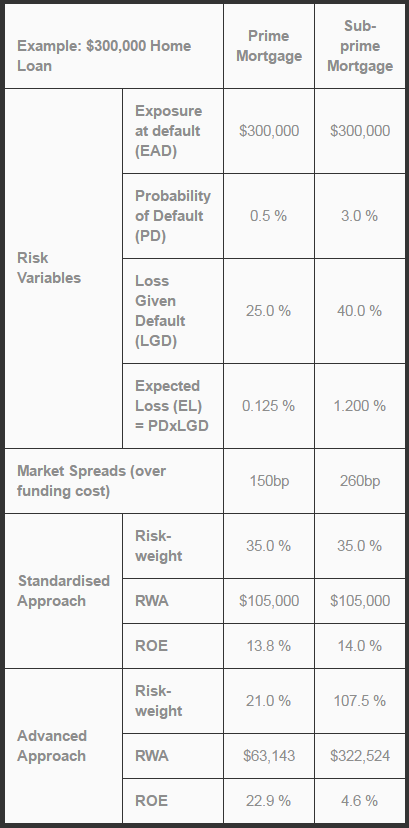

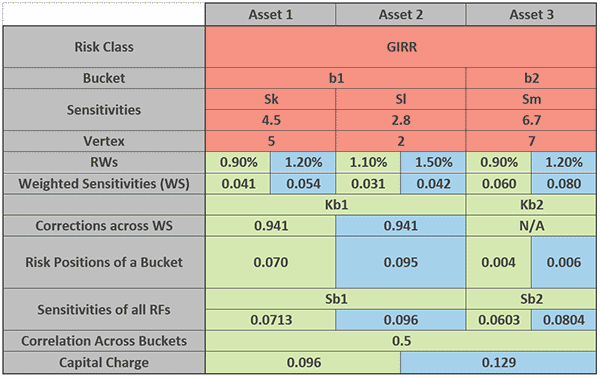

Meaning of Capital charge and calculation of capital requirement — Banking School - India Dictionary

:max_bytes(150000):strip_icc()/dotdash_Final_Tier_1_Leverage_Ratio_Definition_Nov_2020-01-4741405e9a8f49b79939f1a51fc3de54.jpg)